Accounting for Returned ACH Payments

in VRM

Generally the bank automatically debits the client’s bank account for the total amount of the

NACHA (ACH) file on the date an ACH file is uploaded to the Bank Website. Once the account has been debited for the NACHA file total, all items in that file can be considered “cleared” by the bank. So, if there are ten owner payments in the file, there are ten Direct Deposit “checks” in that file. The value for each one of those 10 payments is debited from your bank account on the night of the upload. The direct deposits are literally “cleared.” The total amount debited from your bank account will be on your monthly bank statement.

Occasionally an ACH payment will be returned from the bank due to incorrect bank account information provided on the ACH (NACHA) file sent from VRM to the Bank. This may be due a clerical error inputting routing and account number information on the owner record or due to an account closure on the part of the owner. The ACH return, will usually be reported two days after the original debit and is recorded on the bank statement as either a deposit or a credit to your account.

It seems intuitive to undo a returned ACH payment in VRM if it is returned by the bank.

This is why undoing a direct deposit in VRM is a BAD IDEA:

1. You change history. If you undo the DD item that was returned, then the original ACH file

that you uploaded to the bank and have stored on your hard drive no longer

resembles what is in the check register in VRM. Your bank will have debited your account for the original amount on the ACH file but the VRM check register version now has no record of the undone DD. Instead, it is reporting not the original debited amount, but that amount less the DD you have undone. This is not good. NEVER UNDO either an electronic or paper check that has left your hands either on paper or electronically.

2. The owner statement is changed from the original version sent to your owner. The original owner statement records the owner payment along with the original Direct Deposit information. If the Direct Deposit is undone, the owner statement will be changed so that the owner statement in VRM after the direct deposit is undone will not resemble the statement you sent to the owner.

3. It may be hard to reconcile your bank statement with VRM. This would be a problem if the ACH debit occurred in one month and the returned deposit was posted to your account in the following month. In this case, if the original DD was undone, your reconciliation would be out the amount of the undone item and would not be reconciled until the following month’s statement.

In the case of a returned Direct Deposit (ACH item), we recommend that you create and pay a

receivable to credit the owner or vendor account for the ACH return through Accounts Receivable. The recommended procedure details follow:

1. Post a credit to the account originally debited (owner or vendor) through accounts receivable on the date that the ACH return was posted to your bank account.

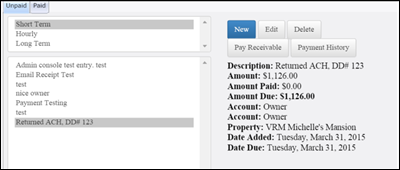

a. First Create the Receivable in Accounts Receivable

i. Accounts receivable > highlight the property type for the account originally debited, usually long term or short term

ii. Select “New”

iii. Select the Property name

iv. Select the Account to credit, usually owner

v. Enter the amount of the returned ACH

vi. Enter the date the returned item was reported by your bank

vii. Enter the description i.e., “Returned ACH, DD# 123”

viii. Select “Save”

b. Second Pay the Receivable

i. In Accounts Receivable>Unpaid Tab

ii. Highlite the property type for the account originally debited, usually Long term or Short term

iii. Highlite the receivable created in a. above

iv. Select “Pay Receivable”

v. Enter cash, date and amount returned

vi. Select “Make Payment.”

2. Create and clear a bank deposit in VRM to account for the returned ACH on your bank statement

a. Once you have created and paid the receivable you will need to create a bank deposit in Accounting > Deposits. The deposit should be created for the same date that the ACH was returned to your account.

b. Once the deposit has been created you will be able to clear it on the current bank

reconciliation.

3. The steps above will return the owner payment to the owner account and you will

then be able to reissue the owner payment by paper check or repeat ACH (assuming

that the original problem has been corrected.

Revision 2.0