How VRM Handles Pre-deduct Travel Agents

Definition:

A Pre-deduct Travel Agent is one who retains their booking commission when sending payment for a reservation. The payment submitted to the management company usually includes taxes and all other fees except for the commission amount due to the Travel Agent.

How it works:

The reservation must display the full rental price including the Travel Agent Commission and total cost of the reservation in order to calculate taxes and any Travel Insurance correctly. The rental price cannot be reduced to account for the pre-deducted commission.

When the reservation is made, the Pre-deduct travel agent is added prior to completion of the reservation process and when the reservation process is completed there is an automatic payment matching the calculated amount of the TA’s commission posted automatically in “Pay-Up!” as a “Credit/No Money” Payment. This appears in the Payment History on the Pay Up! screen. The

Credit/No Money amount plus the amount submitted by the travel Agent should

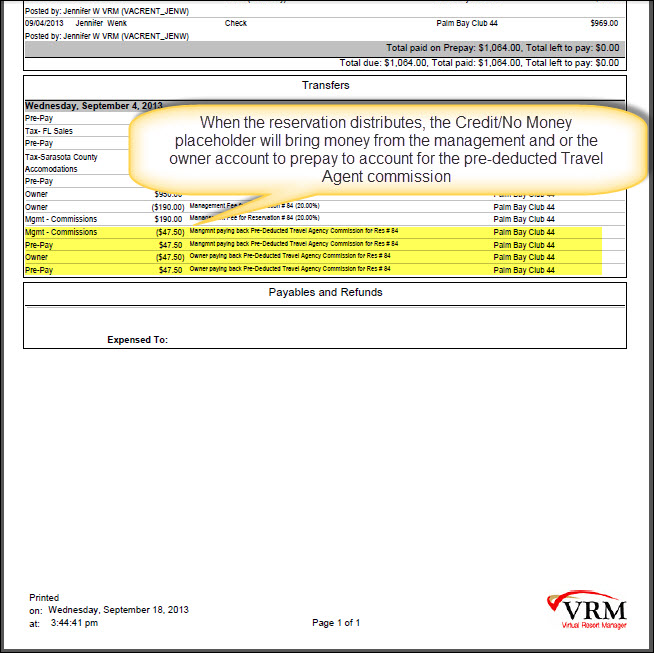

equal the total cost of the reservation. When the reservation is distributed after guest arrival/departure the full rental price is distributed to the owner

account. The Credit/No Money amount is deducted from the owner/management accounts (based on the initial configuration for this Travel Agent) to replace the Credit/No Money Place Holder.

Criteria for Performance:

1. The Pre-deduct Travel Agent must be set up in the VRM system. The percent of the agent’s commission to be shared by the property owner and management must be predefined on the Travel Agent Record in the system configuration (System Configuration > Company > Travel

Agencies) prior to the initiation of the reservation process through the admin console.

2. The Pre-Deduct Travel Agent must be applied to the reservation BEFORE the reservation is actually reserved. The Credit/No Money calculation will not work correctly if the Travel Agent is added after

the Reservation is made. A manual application of a Credit/No money payment will not distribute correctly if added after the reservation is made.

3. The only way to apply a discount is to add the discount along with the Travel Agent when initiating the reservation process. If the travel agent commission is to be paid on a discounted rent and if the discount was added after the reservation was made, the Travel Agent Commission will need to be calculated on the discounted rental price and the “credit no money” amount edited on the PayUp! Payment history screen. Negative add to rent discounts (as in revenue management) also will not calculate the TA commission correctly.

Points of Information:

1. Credit/No Money payments display on the General Screen and the Payment History screen of a reservation in Amount Paid but will not display in the Pre-Pay balance on the Summary Screen.

2. There is no reference to Credit/No Money payments in the following Reports: Cash receipts, Deposit Worksheet, Accounting Audit Trail.

3. When a reservation distributes, an automatic Credit/No money payment set up when a pre-deduct TA is added prior to initiating a reservation will be replaced by a debit from the owner/management accounts to replace the credit/no money transaction.

4. When a Credit/No Money payment has been applied to a reservation incorrectly (after the reservation has been made), the reservation will distribute the full rental price but will not debit the owner/management accounts to replace the Credit/No Money amounts, thus causing the distributed reservation to end with a negative prepay balance.

5. If a rent price is going to be discounted it must be discounted at the time the reservation is made in order for the Credit (no money) to be automatically posted for the correct amount.

6. A pre-deduct travel agent must be applied to the reservation when the reservation is made for the Credit (no money) payment to be automatically created.

The Bottom Line:

·

A pre-deduct travel agent should NEVER be added to a reservation after it has been made because the system will not automatically create the credit (no money) payment.

·

The credit/no money payment must be applied automatically to work correctly.

·

A rental price should NEVER be discounted after a reservation has been made with a pre-deduct travel agent because the automatic credit (no money) payment will not recalculate and the TA commission

will be too high.