Companies that accept eChecks are able to save

thousands of dollars a year in transaction fees. Although there is a fee charged for each

eCheck processed, the fee is much smaller than that associated with a credit

card. Unlike a credit card fee, the fee

is not a percentage of the purchase price; a flat fee is charged per

check. Additional charges for utilizing

this functionality include a one-time set-up fee and a small monthly

maintenance fee.

The set-up process to start taking eChecks is not

complicated. You will first need to

complete an application from the Profit Stars, which we will provide. Once the application has been submitted and approved, our staff will

complete the necessary programming; this usually takes about ten business days. After a little training, you will be on your

way to a better customer experience and a more efficient office.

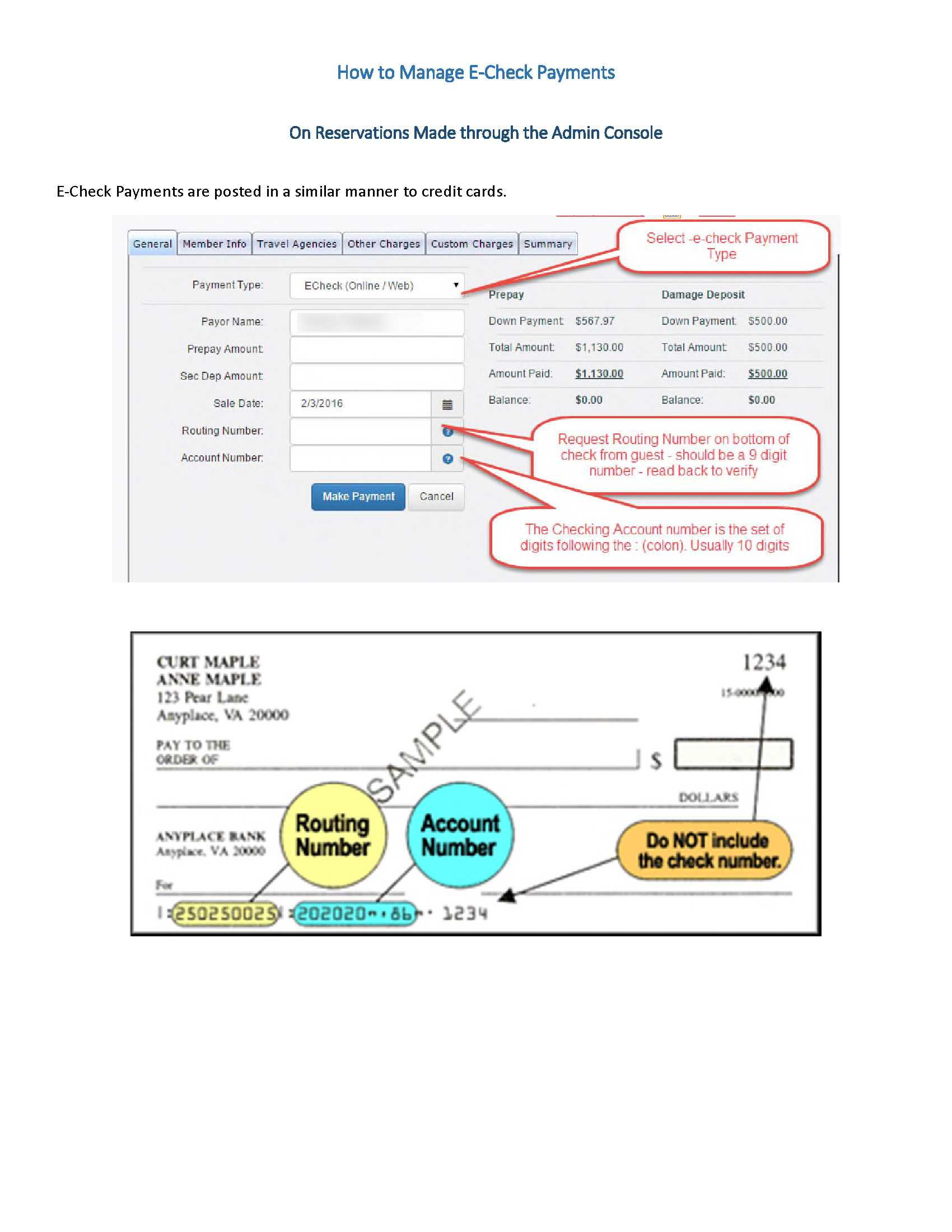

The process for accepting an eCheck is fairly

straightforward for both you and your Guests. For eCheck reservations being

taken over the telephone, the reservationists needs to select “eCheck” from the

“Payment Type” drop down menu on the “Pay Up” screen and then ask the Guest to

provide the bank account information that appears on their regular checks

(routing number and account number) as well as the amount they would like to

pay.

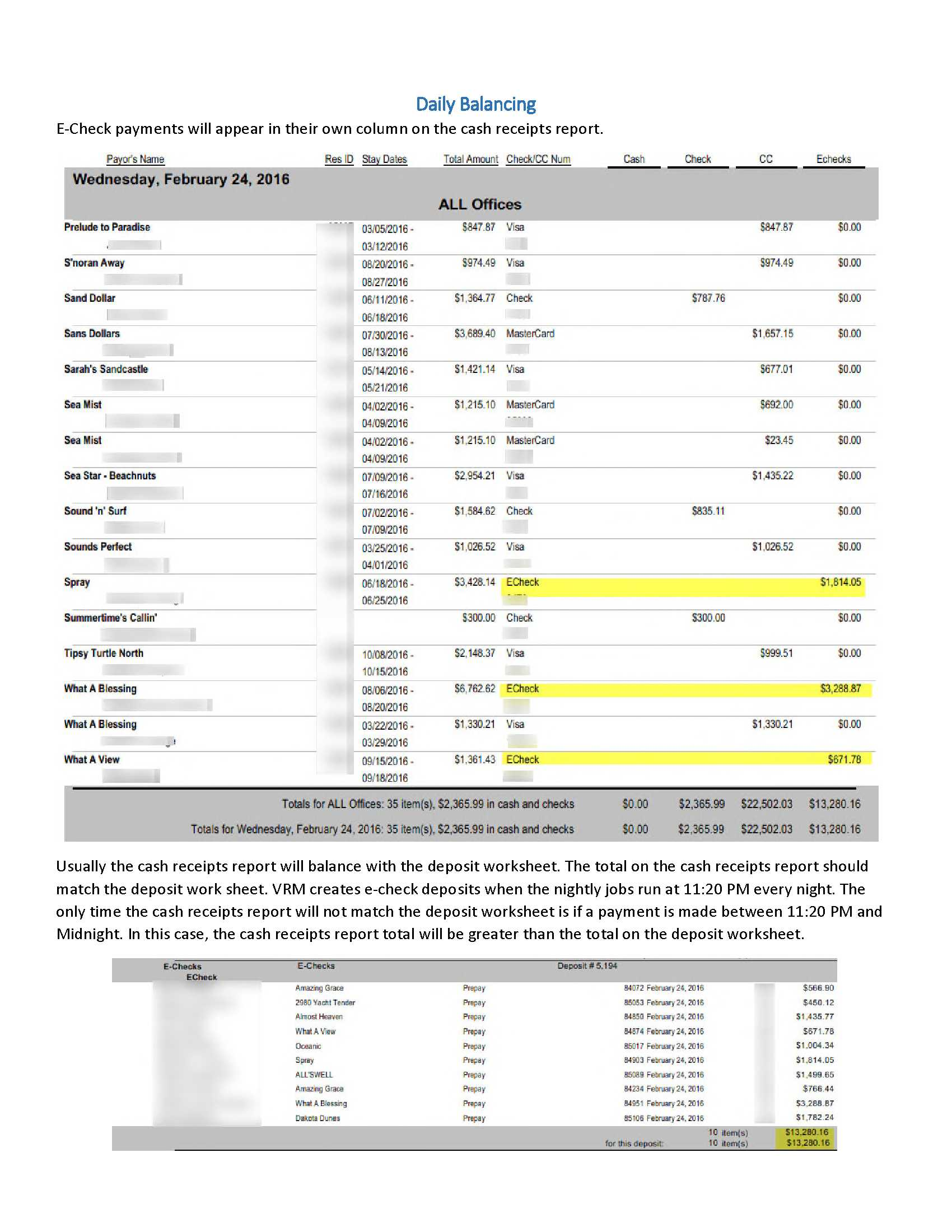

Regardless of whether the payment is taken

online or over the phone, once the payment details have been entered, the

information will be sent electronically to the Automated Clearing House (ACH)

Network, which will transfer the money from the Guest’s account to yours. It usually takes about 48-72 hours before the

money is available in your account. If

there is a problem with the eCheck, you should be notified within one or two

days of submitting it.

For additional information or to get started,

please contact Help@vrmgr.com

Revision 2.1