Changing Tax Rates

When tax rates change the end user can configure specific tax rates to adjust on a specific

date.

Perform the following steps to configure tax rates to adjust on a specific date:

1. Select the System Configuration button from the VRM main menu.

2. Select the Financial button.

3. Select the Taxes tab.

4. Highlight the tax entry which will be changing.

5. Select the Edit button.

6. Enter the value the tax will be changing to within the 'Future Rate (%)' field.

7. Select the calendar arrow keys to the specific month the tax rate will be changing.

8. Select the specific day within the month when the tax rate will be changing.

9. Select the Save button.

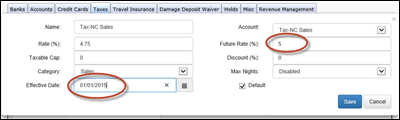

Example: The Tax, Sales tax is increasing on January 1, 2015 from 4.75% % to

5%. I would set the configuration of the 'Tax-NC Sales' tax type to the

following and then select the Save button.

Notes:

A. All preexisting reservations which were made before the tax increase yet arrive on or after the new tax effective date will contain the new tax rate.

Example: I make a reservation on December 10, 2014 for July 4, 2015. When the reservation was made on December 10, 2014 the tax rate was 4.75%. I configure my tax rate to adjust to 5% on January 1, 2015. When this reservation is reopened the tax rate will recalculate with the new 5% tax rate.

B. The old tax rate will apply to all reservations arriving before the date the tax increases.

Example: I configure the tax increase of 4.75% to 5% to occur on January 1, 2015. I make a

reservation for December 7, 2014 to December 14, 2014. The reservation will be taxed at the tax rate of 4.75%.

C. Only one future tax rate can be applied at a time. If the tax rate changes again during the same year, the new future rate cannot be applied until after the effective date of the previous change.

Example: The 'Tax-NC Sales' tax is changing from 4.75% to 5% in January and

then changing from 5% to 6% in March. The end user would configure the tax type with

a 'Future tax' amount of 5 and a date of January 1. The end user would have to wait until

January 1, when the new 5% tax rate becomes active before configuring the next tax rate

increase of 6% to occur in March. After January 1, the end user can configure the 'Tax,

County Occupancy' tax type with a future tax amount of 6 with a date of March 1.